When to open long positions on GBP/USD:

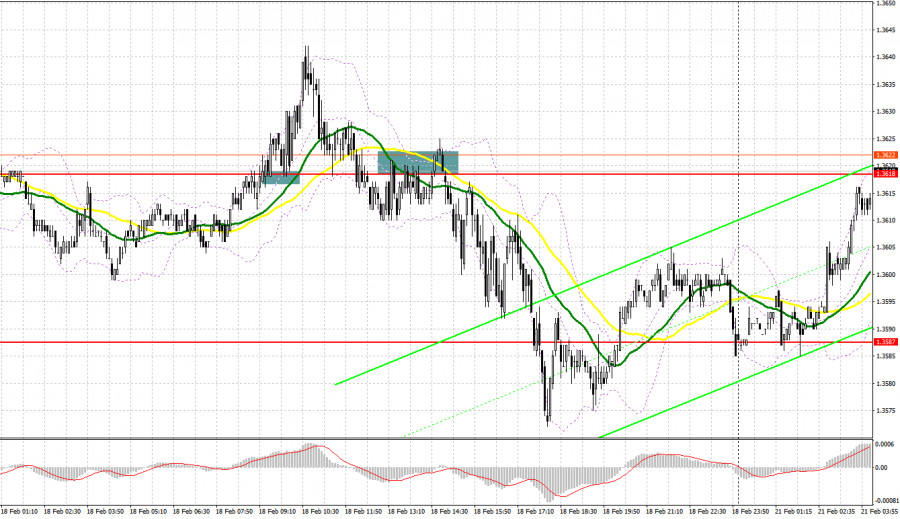

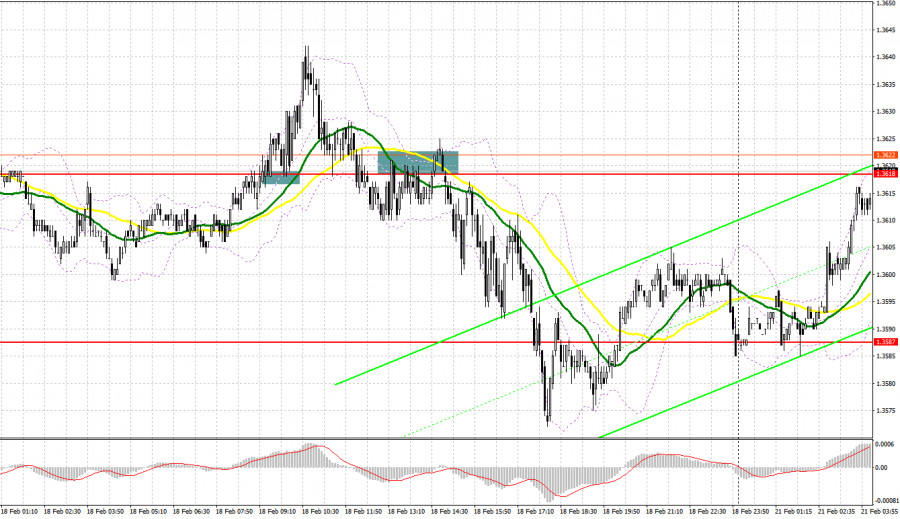

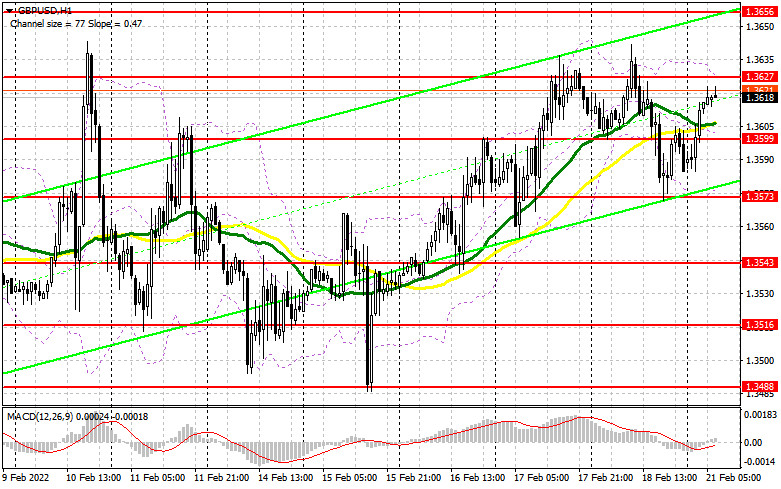

A few entry signals were produced on Friday. Let's switch to the M5 chart and analyze them. Last time, I said you should focus your attention on 1.3618 and consider entering the market from this level. In the first half of the day, the pair soared amid strong retail sales data in the United Kingdom. The price broke through 1.3618 and consolidated above it, and a buy signal was generated as a result. Overall, the pair rose by 25 pips. Yet, it failed to reach the target. In the second half of the day, the pound came under pressure and fell below 1.3618. A signal to sell the instrument was produced after a retest of the mark from bottom to top. Later, the quote descended to 1.3587 – a profit of 30 pips.

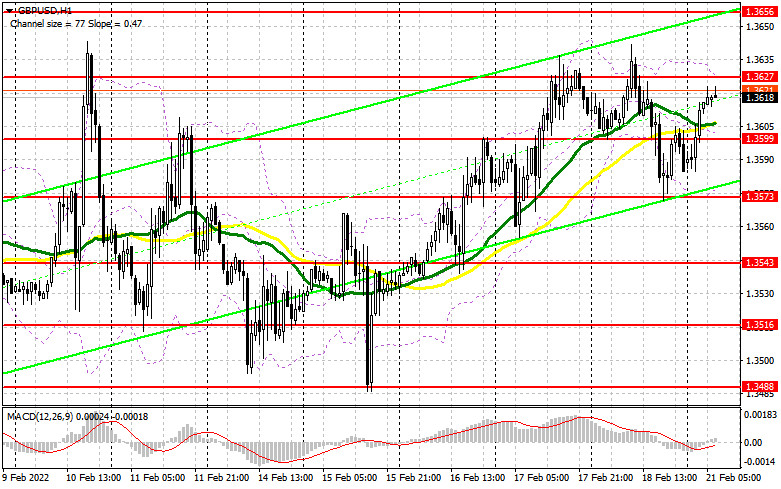

Today, traders will focus their attention on business activity in the United Kingdom. The volume of long positions on GBP/USD might increase amid a rise in the figures. At the same time, the pair's growth might be restrained amid the further aggravation of tensions between Russia and Ukraine. In such a case, risk assets will unlikely add gains. The bulls are now planning to break through the resistance level of 1.3627. They failed to settle above it on Friday. In the European session, the bulls will also try to protect the support level of 1.3599 with the moving averages passing there. In the event of disappointing business activity results in the United Kingdom and a fall in the price, long positions could be considered from the level of 1.3599. The quote might soar to the support level of 1.3627 after a false breakout there. An additional buy signal might be produced after a breakout and a test of this range from top to bottom. If so, the pair might recover to the new February high of 1.3656. Traders should lock in profits if the quote reaches the target at 1.3694. In case GBP/USD descends in the European session and the bulls remain inactive at 1.3599, a small bearish correction is expected with the level of 1.3573 seen as support. A false breakout there would generate a buy signal. However, the pair might come under pressure amid the escalation of Russia-Ukraine tensions. Long positions on GBP/USD could be entered on a bounce off 1.3543 or the low of 1.3516, allowing a 20-25 pips correction intraday.

When to open short positions on GBP/USD:

The bears risk losing control over the market. That is why they should protect the resistance level of 1.3627. A signal to sell the pound might be produced if the bears say active in the first half of the day, forming a false breakout, and business activity data in the United Kingdom come in disappointing. Most major players expect the pair to hit new February highs. The target is seen at the support level of 1.3599 with the moving averages passing there. In the event of a weaker services PMI, pressure on the instrument might increase. An additional sell entry point might be formed after a breakout and a retest at 1.3599 with targets at 1.3573 and 1.3543. The range of 1.3516 is seen as a farther target where traders should lock in profits. If the pair goes up in the European session and the bears are inactive at 1.3627, short positions could be entered as the price hits the new monthly high of 1.3656. Traders could go short after a false breakout there. It would be possible to sell the GBP/USD pair on a bounce off 1.3694, allowing a 20-25 pips correction intraday.

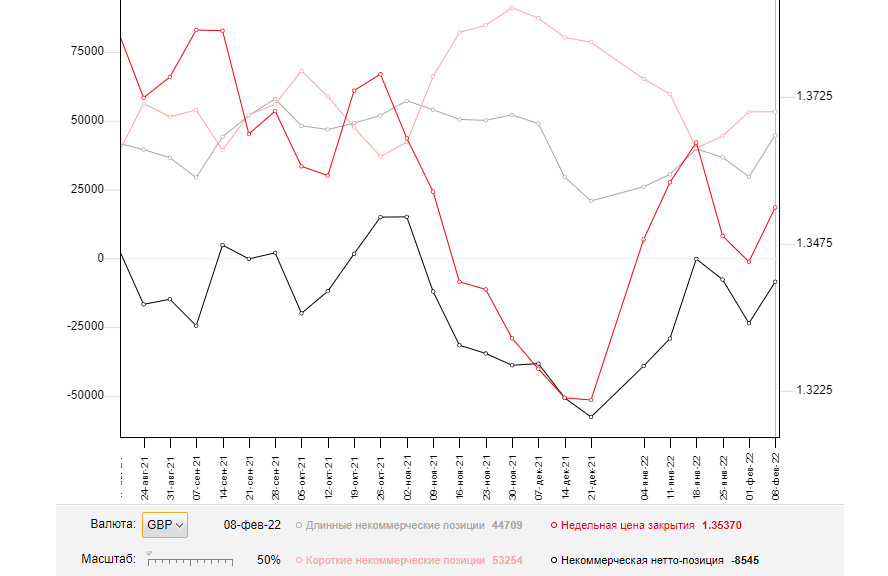

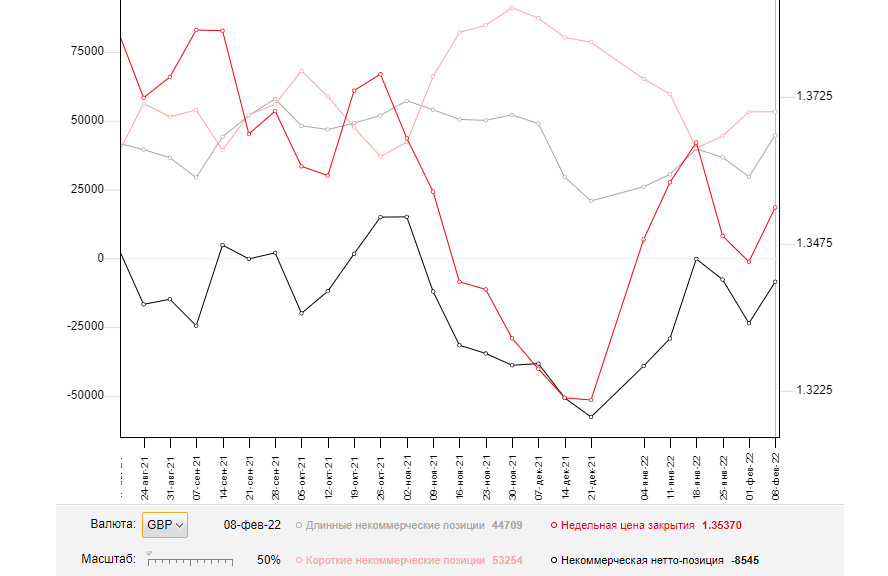

The COT report as of February 8 logged a rise in short and long positions. An increase in longs had been more significant, which led to a rise in the negative delta. Nevertheless, the market remains under the bears' control due to the negative delta. The report also takes into account the outcome of the Bank of England's meeting where the regulator announced it would raise interest rates. The rate hike did not help the pound to recoup losses because the central bank had made this move to tame soaring inflation. The British economy is going through tough times, so economic growth might slow down at any time. Generally speaking, the rate hike did not trigger a rise in the sterling. In addition, geopolitical risks and a possible rate hike by the US Fed in March are weighing on the bulls and considered a restraining factor for the bullish market of GBP/USD. Some traders expect the US central bank to hike the rate by 0.5% instead of 0.25% in March, which is a bullish signal for the US dollar. The COT report as of February 8 revealed an increase in long non-commercial positions to 44,709 versus 29,597 and an uptick in short non-commercial positions to 53,254 from 53,202. The total weekly non-commercial net position advanced to -8,545 versus -23,605. The weekly closing price jumped to 1.3537 from 1.3444.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating the bulls' attempt to extend the uptrend.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The lower band is likely to provide support for the pair at around 1.3573 in the event of a downtrend. A breakout of the upper band at around 1.3627 might cause a rise in the pound.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.