US stock index futures rose in morning trading on Wednesday as investors gained some optimism after another round of corporate reports. The good sentiment is expected to continue today. Dow Jones index futures were up by 2,021 points, or 0.6%. S&P 500 futures added 0.7% and Nasdaq 100 futures gained 0.9%. The Dow Industrial Average climbed by more than 370 points yesterday, boosted by a gain of 7.8% in Amgen shares. The S&P 500 also posted gains, rising by 0.8%. The high-tech Nasdaq Composite surged 1.3%.

Meanwhile, bond yields declined on Wednesday after rising sharply earlier in the week. The yield on the 10-year Treasury bond just recently stood at 1.93%.

There are no statistics to hit the stock market today, but several Federal Reserve officials are expected to speak, including Governor Michelle Bowman and regional bank presidents Loretta Mester from Cleveland and Rafael Bostic from Atlanta. Their statements could have a major impact on market sentiment, so I advise keeping an eye on the interviews.

Harley-Davidson, Chegg, DuPont and Centene have already reported today. Their earnings figures came in above economists' forecasts. As of Tuesday's close, nearly 60% of all S&P 500 companies had reported fourth-quarter earnings, and some 77% had beaten economists' estimates, according to FactSet. Disney, Mattel, MGM Resorts and Uber Technologies will release data after the market opens today.

Investors are also waiting for the US inflation report, which will provide an updated picture and a broader understanding of how the Federal Reserve will act in March this year. Until the state of inflation and the Fed's actions are clearly understood, surges and spikes in volatility can be expected. However, by the time interest rates rise in March this year, the panic should gradually subside as investors will have a responsive plan for further action from the central bank.

On Thursday, the Labour Ministry will publish data on the consumer price index for January. The data will follow a stronger than expected January employment report. This could prompt the Federal Reserve to be more aggressive in its policy stance. The inflation data is expected to show a 0.4% rise in prices in January. This is higher by 7.2% than a year ago. This would be the highest rate in almost 40 years.

The good news for investors is that it appears that the USA is close to a peak in inflation and tomorrow's figure could be it. There have been some recent improvements in supply chains. This is the first sign that inflation is approaching its peak.

Meanwhile, data has emerged that the number of mortgage applications in the US is starting to fall sharply. According to the Bankers Association, the number of home mortgage applications last week in the US dropped by 10% compared to the previous week. The average loan size reached another record high of $446,000, indicating that more expensive homes accounted for most of the buying activity. Meanwhile, the total volume of homes for sale in January was down by 28% year-on-year. However, in anticipation of the end of the low mortgage lending period, which will come after the US rate hike, competition for homes in 2022 is expected to remain quite high. In January, homes sold at a record pace. This suggests that buyers are more active than usual at this time of year.

Premarket

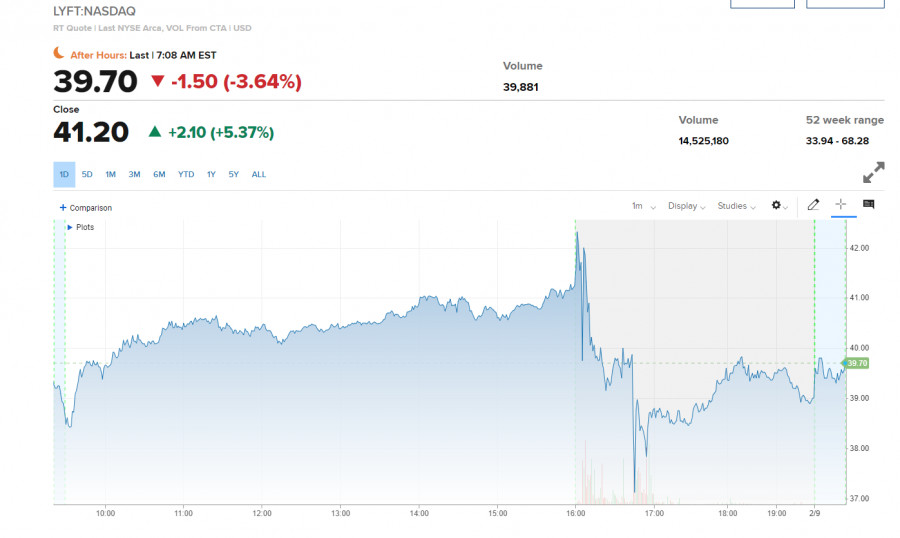

Chirotle gained more than 6% at the premarket on strong earnings, while Lyft shares fell almost by 4% following the announcement that they had fewer active riders than in the previous quarter. The focus was still on Peloton stock yesterday. The shares continued their recovery today, rising by more than 4% at the premarket after the company announced a restructuring plan which will include the firing of the CEO. Despite all the problems, the stock is already up by 25% since the start of the year.

As for the technical picture of the S&P500

Today we may see another decline to $4,449, which may lead to increased demand and an attempt by buyers of the index to reverse the market and break through $4,536, which they failed to do last Friday. That would take the pair down to $4,598. A breakthrough that range would open a path to $4,665 and $4,722. If the price falls below $4,449, the pressure may return very quickly. In that case, we might see a decrease to $4,378.