Friday's inflation did not scare away those wishing to invest in the US securities market, and the observed boom continued today in the futures markets. Stock futures indices rose early Monday morning after the S&P 500 posted its best week since February of this year at a new record close. It is worth noting that the index recovered very quickly after a big sell-off caused by concerns about a new strain of the omicron coronavirus. Dow Jones Industrial Average futures are trading 75 points higher, or 0.2%. S&P 500 futures were up 0.3% and Nasdaq 100 futures were up 0.4%.

The fact that inflation in the US has completely coincided with economists' forecasts makes markets and investors more confident in the further steps taken by the Federal Reserve System. I think many people now do not doubt that unexpected decisions should not be expected during the last December meeting of the committee. Therefore, the demand for risk and risky assets is gradually gaining strength. As data showed last week, the consumer price index in the United States for November of this year jumped to 6.8% - being at another peak level since the 80s. Investors perceived the jump in general inflation data as quite predictable, which did not cause panic in the markets.

At the end of last week, the Dow Jones blue chips rose by 4%, breaking a four-week losing streak and showing the best weekly performance since March. The S&P 500 and Nasdaq Composite indexes jumped 3.8% and 3.6% last week, respectively, showing the best results for the week since the beginning of February.

Many now believe that the risks of more stable inflation will continue to persist for quite a long period. However, the easing of restrictions and disruptions in supply chains, which is planned by the end of the first quarter of next year, should have a positive impact on inflation – reducing it to a more comfortable level.

Let me remind you that this week the results of the two-day meeting of the Federal Reserve System will be published, at which politicians are expected to discuss the completion of the bond purchase program. We should also talk about the timing of the first increase in interest rates in the United States since the coronavirus pandemic. Fed Chairman Jerome Powell, as well as several speakers from the Fed, recently suggested that the central bank could complete a $120 billion-a-month bond purchase program earlier than the current schedule - June 2022. It is expected that strong economic growth, the recovery of the labor market, and increased inflation will push the Fed to change policy and, in particular, to end the quantitative easing program in the near future.

The growth of the US stock market also has every chance to continue, as concerns about the new Covid strain have been exaggerated. Many were also comforted by the news from Pfizer and BioNTech that three doses of their vaccine provide a high level of protection against omicron. As of Monday morning, in the United States, the number of deaths from coronavirus has approached the 800,000 mark. The new option has pushed some government officials to reinstate restrictions.

Let's run through the premarket and talk about the news:

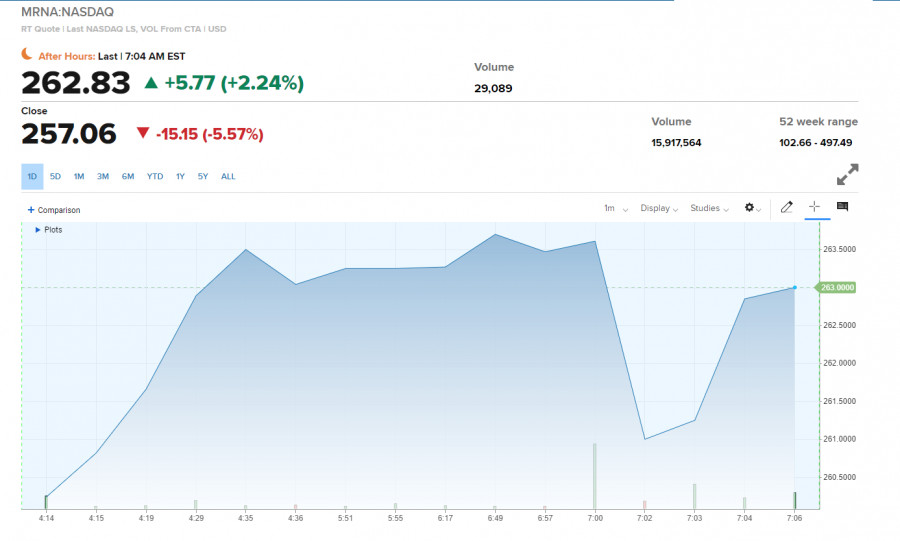

On Monday, at the premarket, Moderna shares were one of the strongest leaders. The increase was 2.4% a day after the White House's chief expert on infectious diseases, Dr. Anthony Fauci, called Covid revaccination "the optimal way out of a pandemic." He also noted that the definition of full vaccination will not change.

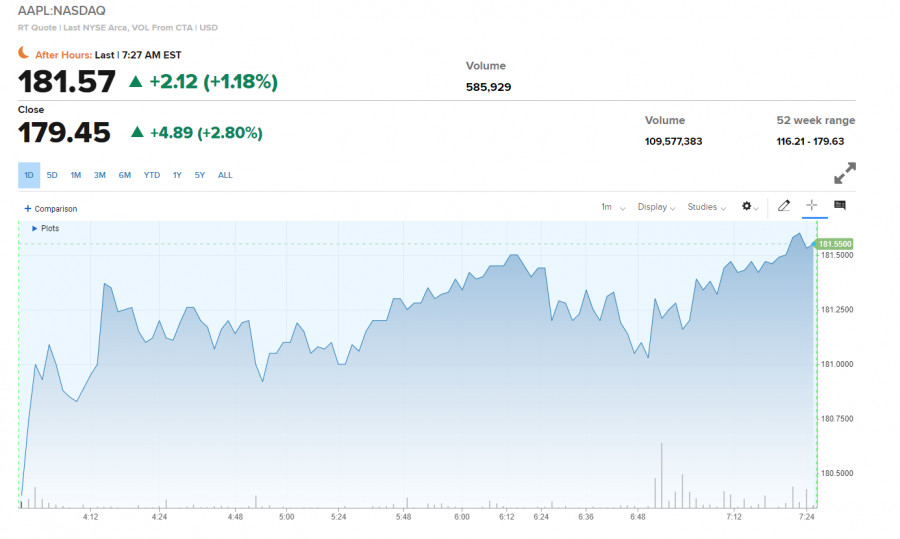

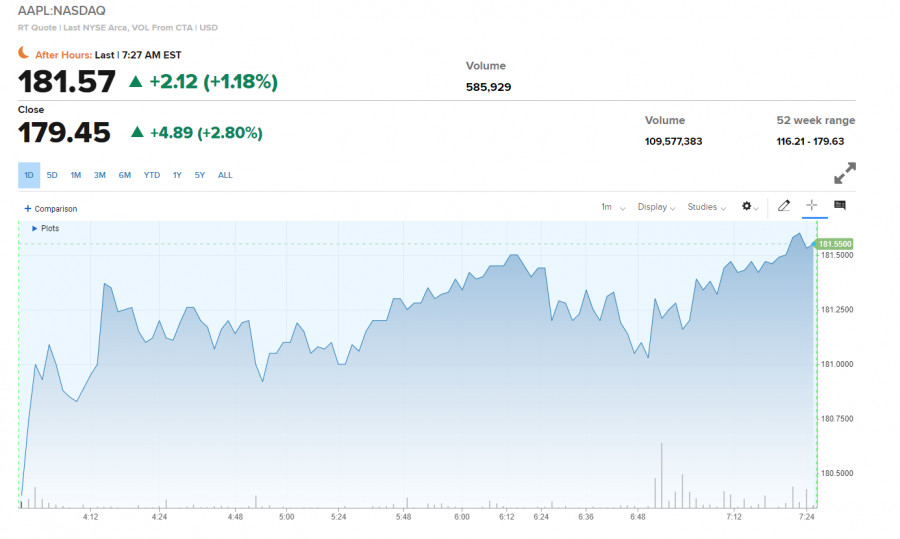

Apple received another 1% in the premarket, gradually approaching its price to become the first company in the market with a capitalization of $ 3 trillion.

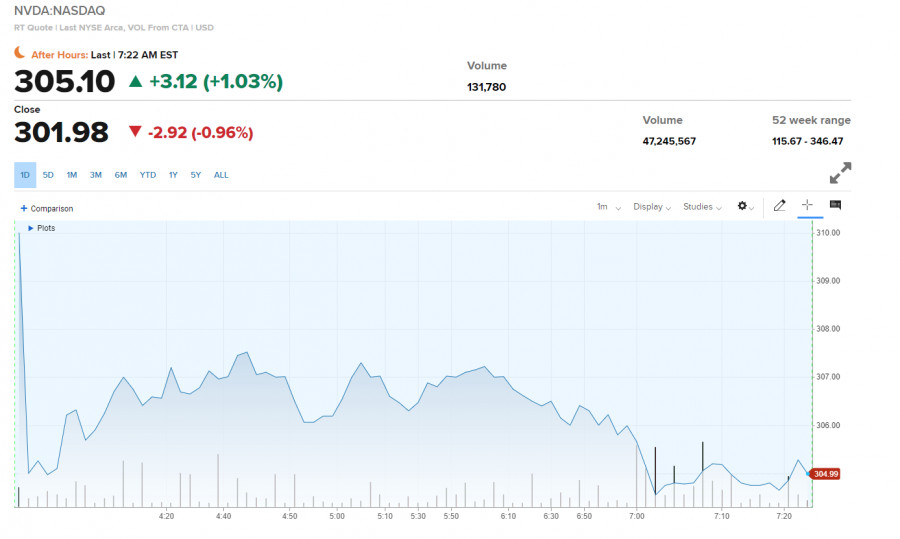

Nvidia's securities rose by 1.7% due to optimism that the new omicron strain will not be as destructive as originally thought.

As for the technical picture of the S&P500

If the bulls manage to gain a foothold above the $4,178 level, this is a strong bullish signal, which may lead to an update of historical highs and an exit of the index at $4,761 and $4,800. If traders miss $4,718, it is best to wait for a decline and correction to the area of $4,665 and act from there more aggressively to build up long positions.