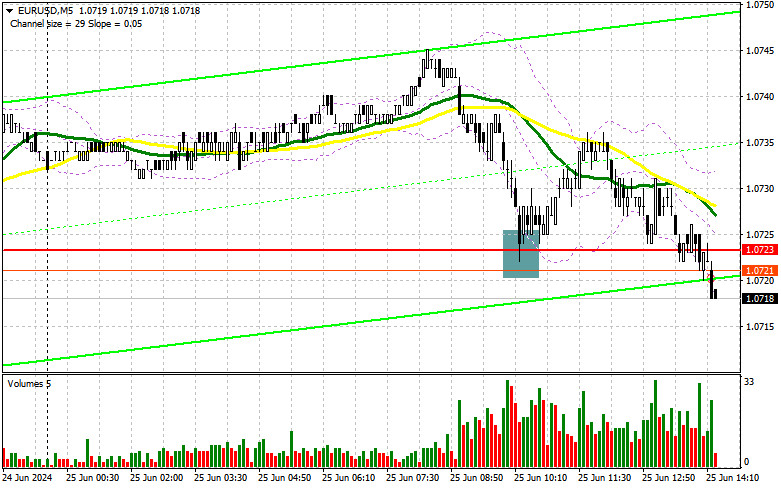

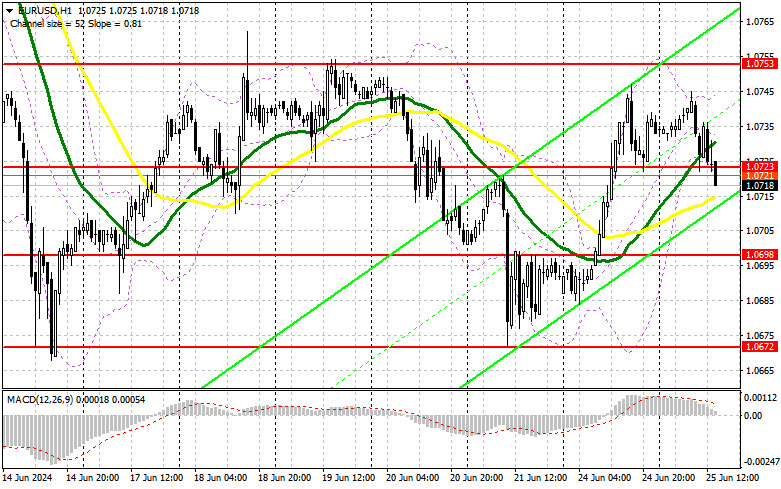

In my morning forecast, I highlighted the level of 1.0723 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout provided a good entry point to buy the euro, resulting in the pair rising only by 12 points before pressure returned to the pair. The technical outlook remained unchanged for the second half of the day.

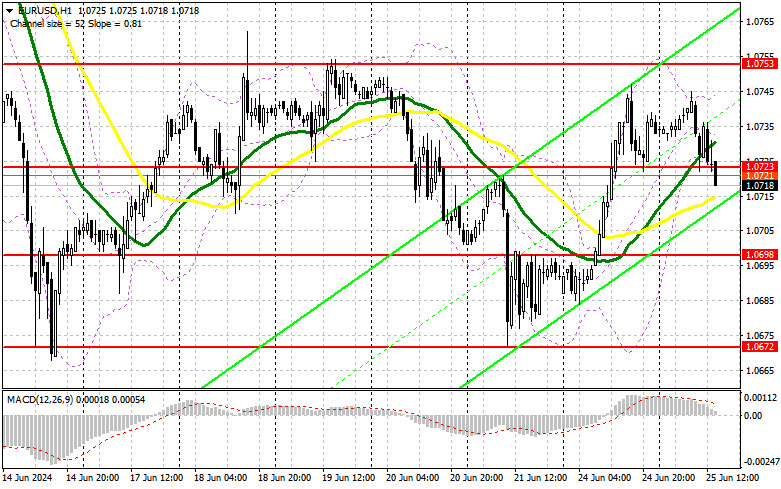

To open long positions on EUR/USD, the following is required:Considering the absence of important statistics from the Eurozone, buyers attempted to defend the nearest support. However, the outcome was mediocre, which is evident given that yesterday's euro rally was difficult to characterize as fitting market conditions. The bears may be currently reversing yesterday's inefficiency. Strong data in the second half of the day on the US Consumer Confidence Index, Housing Price Index, and Richmond Fed Manufacturing Index could exert even more pressure on the pair, which I intend to capitalize on. Therefore, only the formation of a false breakout around 1.0698, similar to what I discussed earlier, would be a suitable entry point for long positions, targeting an update to 1.0723 – the resistance that acted as support earlier in the morning. Just below this level are the moving averages, so a breakout and a top-down renewal of this range will strengthen the pair with potential for growth towards 1.0753. The furthest target will be around 1.0785, where I plan to take profits. Testing this level will restore advantage to buyers.In the scenario of EUR/USD decline and lack of activity around 1.0698 in the second half of the day, sellers will reverse all of yesterday's gains, aiming for the lower boundary of the sideways channel. In such a case, I will only enter after a false breakout form around the next support at 1.0672. I plan to initiate long positions immediately on a rebound from 1.0642, targeting an upward correction of 30-35 pips within the day.To open short positions on EUR/USD, the following is required:Sellers have shown themselves quite well, and now it is crucial to establish below 1.0723. In the event of a bullish market reaction to US data, which cannot be ruled out, defending the nearest resistance at 1.0753 and a false breakout there would provide a suitable entry point for short positions, targeting a decline of the pair towards support at 1.0723. A breakout and consolidation below this range against the backdrop of strong US statistics, along with a reverse top-up test, would provide another selling point with a move towards a new low around 1.0698, where I expect to see a more active bullish response. The furthest target will be around the low of 1.0672, where I will take profit.In the scenario of EUR/USD moving upwards in the second half of the day and the absence of bears at 1.0753, buyers will be able to return to building upward correction. In such a case, I will postpone selling until testing the next resistance at 1.0785. I will sell there as well, but only after an unsuccessful consolidation. I plan to initiate short positions immediately on a rebound from 1.0816, targeting a downward correction of 30-35 points.

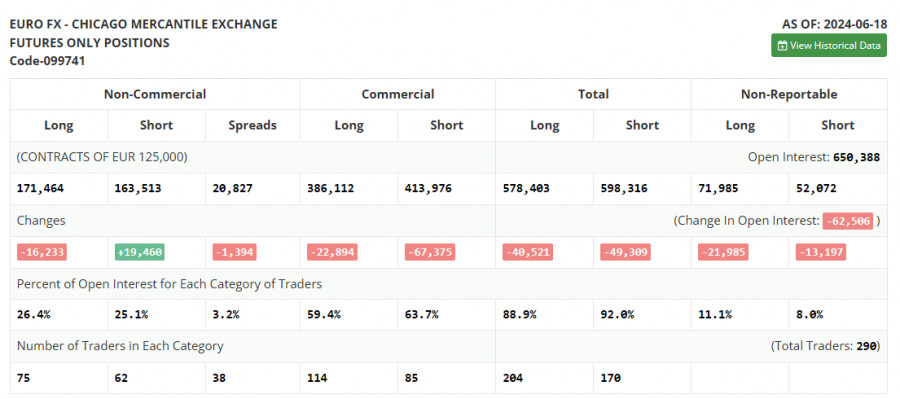

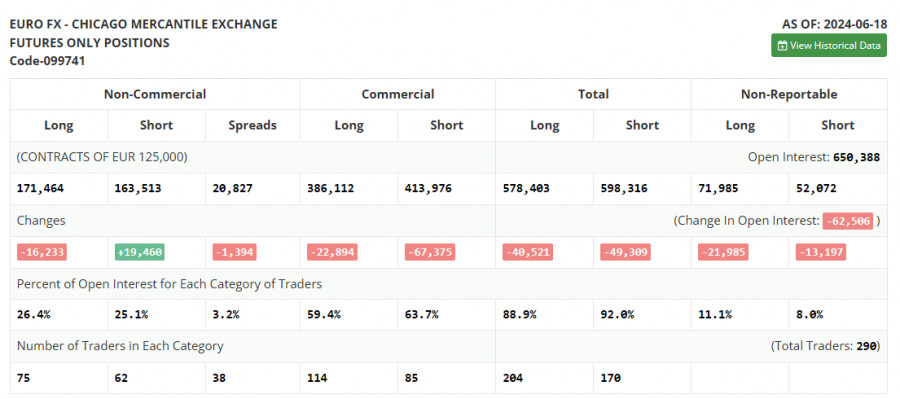

In the COT (Commitment of Traders) report for June 18, there was an increase in short positions and a reduction in long positions. The outcomes of the Federal Reserve and the European Central Bank meetings were noticed, significantly impacting the market dynamics. The total number of short and long positions also confirms the current balance and equilibrium observed on the chart. Considering that no significant statistics are expected in the near future, this equilibrium is likely to persist. However, it should be understood that the overall trend and bearish direction of EUR/USD have not disappeared, and the euro's decline could resume at any moment. According to the COT report, non-commercial long positions decreased by 16,233 to 171,464, while non-commercial short positions increased by 19,460 to 163,513. As a result, the spread between long and short positions decreased by 1,394.

Signals from Indicators:Moving AveragesTrading is around the 30 and 50-day moving averages, indicating a sideways market.Note: The period and prices of moving averages considered by the author are on the hourly chart (H1) and differ from the general definition of classic daily moving averages on the daily chart (D1).Bollinger BandsIn case of a decline, the lower boundary of the indicator, around 1.0723, will act as support.Description of Indicators:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked on the chart in yellow.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked on the chart in green.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, Signal SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The net non-commercial position is the difference between short and long positions of non-commercial traders.