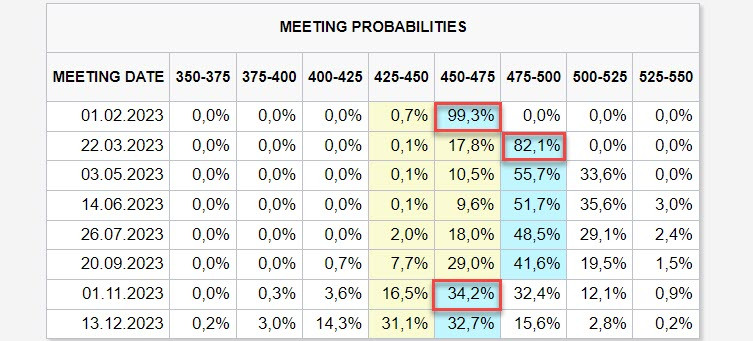

The main event of the day will be the FOMC meeting. According to the CME futures market, the consensus is that the FOMC is going to raise the rate by 0.25% and there will be another one in March and that will end the cycle. The first cut is expected in November.

Markets are in limbo waiting for the outcome of the Federal Reserve, European Central Bank and Bank of England meetings and are hardly reacting to the latest macro data being released. Chicago PMI was slightly weaker than expected, but still above November lows. The Conference Board U.S. consumer confidence index fell to 107.1 (from a revised 109.0) due to weaker expectations, while the assessment of the current situation continued to improve. Inflation expectations rose, probably due to slightly higher gasoline prices. The Q4 employment report showed weaker wage growth, which is in favor of lower inflationary pressures, but still remains too high.

Volatility may pick up before the outcome of the FOMC meeting is announced as the ADP private sector employment report and ISM manufacturing report will be out before that, and eurozone inflation data for January will be released. The uncertainty period will end soon.

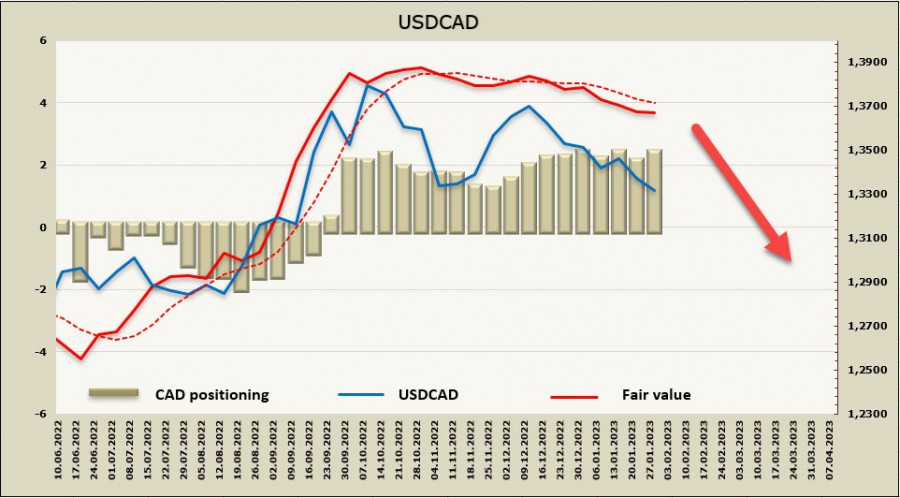

USDCAD

The Canadian economy remains in excess demand as GDP growth in Q4 was +1.65%, year-over-year growth remains in place. In order for the economy to start driving down inflation, GDP growth needs to be lower, which is not happening yet.

The Bank of Canada last week raised its rate by 0.25% to 4%, in line with market expectations, but also made an important caveat in its final statement: "If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases." This means that the Bank of Canada, while retaining the option to raise the rate, nevertheless assumes that there are very good reasons to raise it further, which it has not yet seen.

The markets regard such a position as a "conditional pause". In order to make a decision on further increase, the incoming data should give reasons for such a step; if there are no such reasons, there will be no hike either. Considering that the threat of a global recession is not diminishing, it can be assumed that the Canadian dollar is losing grounds for further appreciation.

Speculative positioning on the CAD remains bearish, with the net short position up 261 million to -2.297 billion for the week, the estimated price is below the long-term average and pointing down, which allows for a further decline in USDCAD.

The loonie is slowly strengthening, but the momentum is very weak to count on a pronounced move. The currency still hasn't reached the 1.3220/30 target, it is possible for the loonie to hit this level if the FOMC gives reasons to do so. In case the market expectations come true, a consolidation below 1.32 is possible and the next target will be support at 1.30. There aren't many reasons for renewal of growth, the resistance is at 1.3310/30, where you may sell with the expectation of a decline.

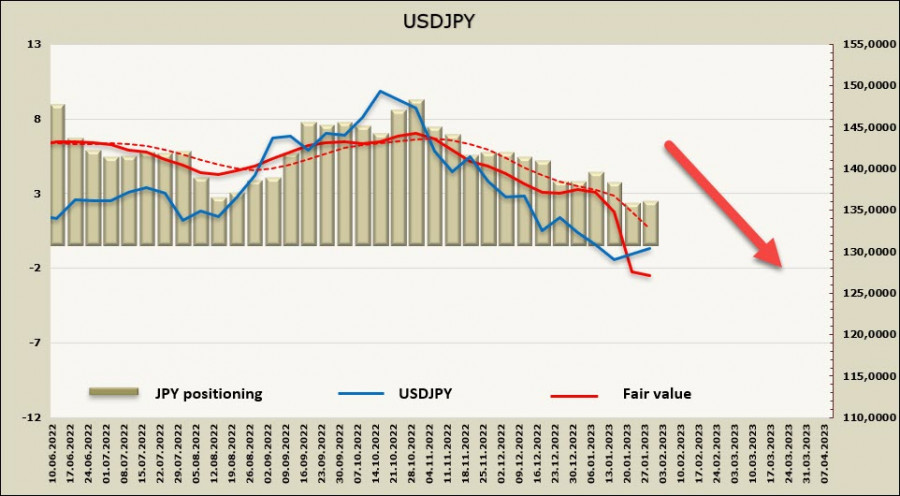

USDJPY

The probability of ending the negative interest rate policy, despite much market speculation, is unlikely to take place even if the Bank of Japan replaces its governor. The reasons are too obvious to ignore - as soon as the market sees that the BOJ is changing direction, a rapid strengthening of the yen will immediately follow, which will lead to a deep recession on the background of a stagnant economy. Forecasts for industrial production in February are uncertain, the inevitable decline in revenues for exporters will trigger a decline in investment, and the problem of servicing the giant debt will lead to a massive increase in the budget deficit.

Japan shifts the fight against inflation to the Fed and other central banks, as their actions are aimed at lowering global inflation, and domestic inflation in Japan is already low.

These considerations suggest that the yen appreciation trend has no strong fundamental underpinnings, and a further decline in USDJPY is unlikely to be pronounced.

The net short position of the yen decreased slightly again during the reporting week by 163 million, to -2.078 billion, the dollar still has the advantage, but the tendency to buy yen on the futures is quite clear. The settlement price is below the long-term average and still has not lost momentum, which gives reason to expect that after the end of the short consolidation, the downtrend will develop further.

The 126.35/55 target, outlined in the previous review, remains relevant. No additional grounds for reviving growth unless, of course, the FOMC provides such grounds. So far, the market's mood for further weakening of the dollar remains, as does the threat of a global recession.