To open long positions on EUR/USD, we need the following conditions:

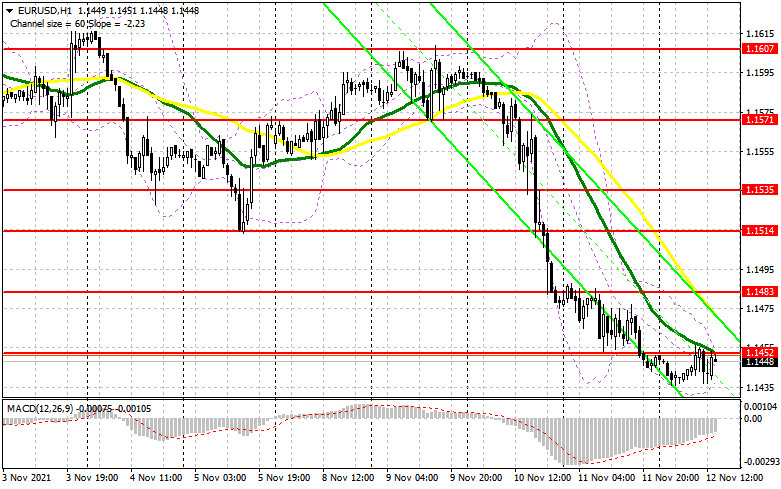

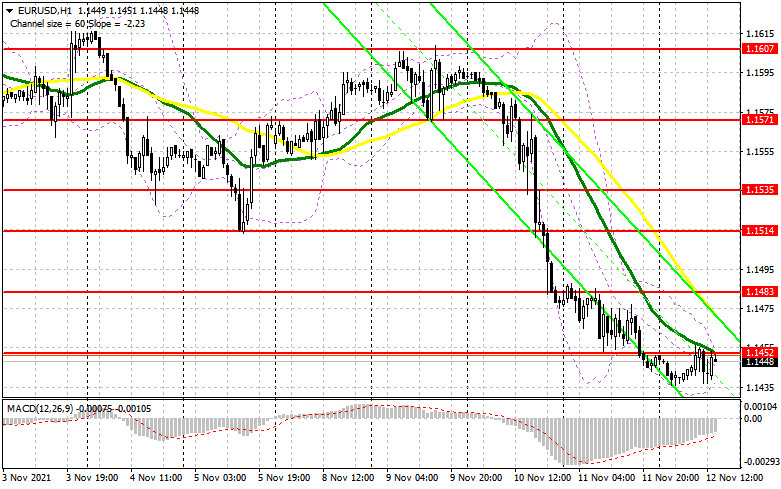

.In the first half of the day, there were several signals to enter the market. Let's look at the 5M chart and figure out the entry points. On the chart, we can see how bulls are trying to regain control of the resistance 1.1452 level. Yet, they are lacking strength. After another unsuccessful attempt, a sell signal has appeared on the chart. Apart from that, the euro did not slump in the first half of the day as many analysts had expected. It dipped by about 15 pips amid intraday volatility. Technical indicators remained unchanged.

Bulls may regain ground provided that the University of Michigan's consumer sentiment, as well as inflation expectations, turn out to be weak. The euro may assert strength only amid a sharp drop in these indicators. Bulls are poised to push the pair to 1.1452. We should be looking for an entry point into long positions if EUR/USD climbs to 1.1483. Near this level, the MACD indicator is moving in the negative territory. It may significantly limit the upward movement of the pair. a new long signal may appear if the pair breaks through this range, rising to a high of 1.1514. At this level, it is recommended to lock in profits. A more distant target level may be 1.1535. The euro's decline is likely to be limited on the back of strong US data, a decline in the quotes, the formation of a false breakout of 1.1415 with the divergence on the MACD indicator on the 1H chart. If so, we are likely to see long a signal with an upward correction. If there is no activity at 1.1415, it is better to wait for the formation of a false breakout of 1.1379. It would be wide to open long positions on EUR/USD immediately at the low of 1.1330, counting on an intraday correction of 15-20 pips.

To open short positions on EUR/USD, we need the following conditions:

Now, bears are in full control. Yet, there was a drop in short positions at lows. After defending the resistance level of 1.1452 in the first half of the day, the euro did not decline further. However, as long as the euro is held below this level, we can expect a new drop. In the second half of the day, bears will continue to defend the resistance level of 1.1452. Only the next formation of a false breakout at this level may give a signal to re-open short positions at the support level of 1.1415. A breakout and a test of this level will increase pressure on EUR/USD, which will open the way to new lows: 1.1379 and 1.1330. It is recommended to close short positions there. If the euro climbs during the US session, it is better to postpone sales until the next resistance test of 1.1483. At this level, the MACD indicator is moving in the negative territory. Even at this level, it would be wise to open short positions after the formation of a false breakout. It is favorable to close short positions on EUR/USD at 1.1514. Take into account a downward correction of 15-20 pips.

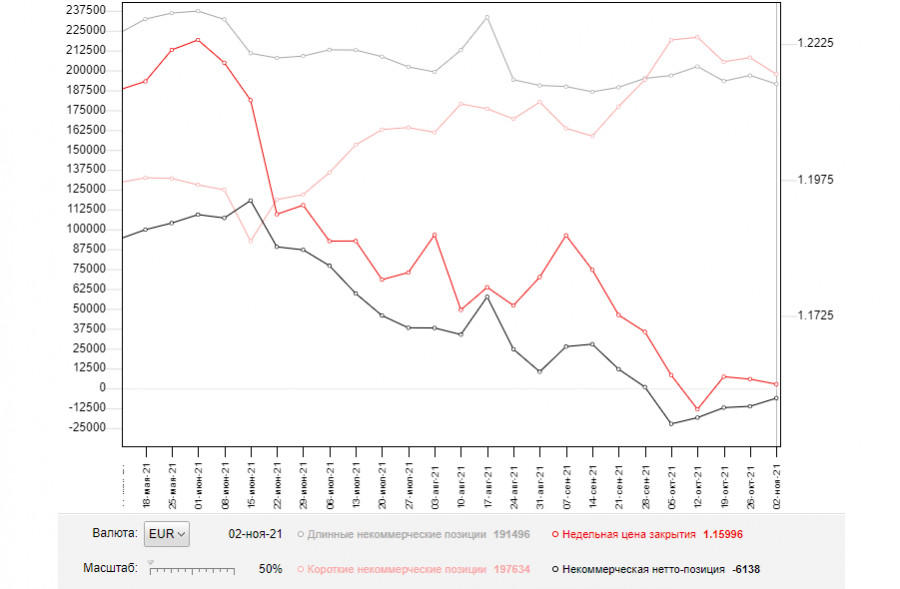

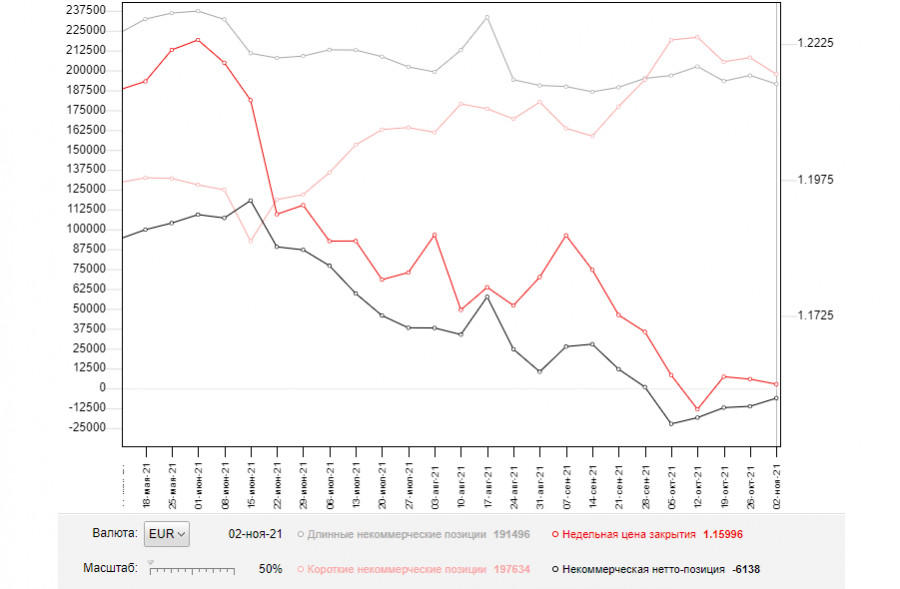

COT report

The COT report (Commitment of Traders) for November 2 showed a drop in both short and long positions, which led to a slight recovery of the negative delta. It indicates that more sellers left the market than buyers. The meetings of central banks did not lead to significant changes. The Fed announced measures to support the economy, fueling optimism across the market. So, traders believe in the continuation of the economic recovery. Some analysts believe that the European Central Bank will have to tighten monetary policy earlier than planned due to high inflation. If so, bulls will have the chance to gain momentum in the medium term. Now, there is a curious situation: after each steep drop, demand for the euro recovers quite quickly. In the near future traders will assess US inflation data. The results of this report will determine the future trajectory of the US dollar against its major rivals. The COT report reveals that the number of long non-commercial positions decreased to 191,496 from 196,880, while short non-commercial positions fell to 197,634 from 208,136. At the end of the week, the total number of non-commercial net positions recovered slightly and amounted to -6,388 against -11,256. The weekly closing price slightly declined to the level of 1.1599 against 1.1608.

Indicator signals

Moving Averages

If trading is carried out below the 30 and 50 day moving averages, which indicates a strong bearish bias.

Note: The period and prices of moving averages viewed by the author on the 1H differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

The euro may rise if it breaks through the upper limit of 1.1455. A breakout of the lower limit of 1.1435 may increase the pressure on the pair.

Description of indicators

- Moving average (moving averages filter out the noise and make it easier to identify trends). Period 50. It is marked in yellow on the chart.

- Moving average (moving averages filter out the noise and make it easier to identify trends). Period 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions show the total number of long positions of non-commercial traders.

- Short non-commercial positions show the total number of short positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.