Analysis of transactions and tips on trading EUR

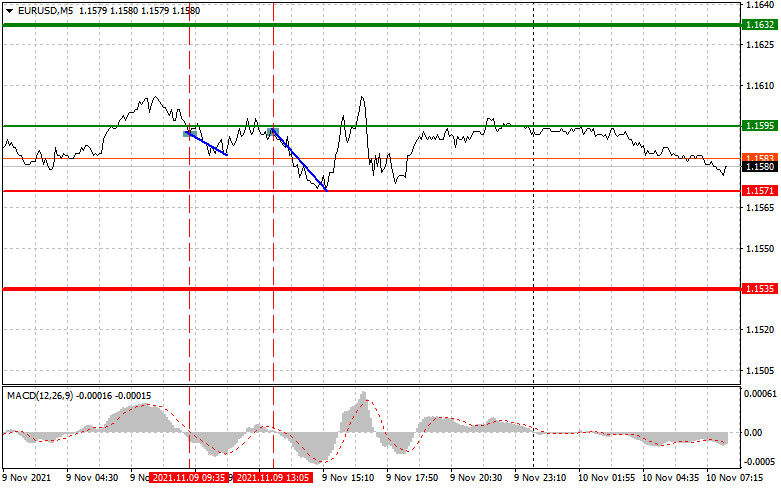

Yesterday, there were several great signals to enter the market. In the first half of the day, the pair was testing the 1.1592 level at 09.35. It coincided with the moment when the MACD indicator started moving down from zero. However, the indicator has already declined significantly. As a result, it limited the downward movement of the euro. After a drop of 10 pips, the euro managed to return to the level of 1.1592. At 13.05, during the test of 1.1592, the MACD indicator was just starting to move down from the zero mark. This led to the formation of a sell signal and to the fall of the euro by more than 25 pips. There were no other entry points on the chart.

The euro failed to strengthen against the US dollar due to yesterday's reports on the trade balance of Germany and Italy, as well as the ZEW indicator of economic sentiment for Germany and the eurozone. Notably, traders ignored the speech of the President of the European Central Bank, Christine Lagarde. The euro/dollar pair faced bearish pressure during the US session following strong data on the US producer price index and the Fed's upbeat finical stability report. Today, it is important to pay close attention to the EU economic reports, namely Germany's consumer price index as well as Italy's industrial production data. Besides, The ECB board member Jens Weidmann is going to make a speech. If the above-mentioned reports turn out to be weak, the euro may fall even more. In the afternoon, the Us will unveil data on the consumer price index as well as the report on the number of initial jobless claims. A strong increase in inflation will certainly revive the demand for the US dollar, which is bearish for the EURUSD pair.

Entry points for long positions

Today, it is recommended to open long positions on the euro when the price reaches 1.1595 (the green line on the chart) with the potential target level of 1.1632. When the price approaches 1.1632, it is better to lock in profits, opening short traders immediately in the opposite direction (counting on a downward movement of 10-15 pips). The euro may only rise only in case of positive economic reports as well as some hints from ECB members about monetary policy tightening. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and is just beginning its rise from it. It is also possible to buy the euro today if the price reaches 1.1571. The MACD indicator should be in the oversold area, which will limit the pair's potential downward movement and lead to an upward reversal. The pair may climb to the opposite levels of 1.1595 and 1.1632.

Entry points for short positions

It is recommended to sell the euro after the price hits the level of 1.1571 (the red line on the chart). The target level will be 1.1535. After the price approaches this level, it is better to close short positions and open ones in the opposite direction (counting on a movement of 10-15 pips in the opposite direction from the level). The euro may again face pressure if the EU economic reports are weak or strong US inflation. It may also signal a big drop in the near future. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and is just beginning its decline from it. It is also possible to sell the euro today if the price reaches 1.1595. The MACD indicator should be in the overbought area, which will limit the potential upward movement of the pair and lead to a downward reversal. There may be also a decline to the opposite levels of 1.1571 and 1.1535

Description of chart:

The thin green line is the entry point for opening long positions on a trading instrument.

The thick green line is the approximate price where you can place a Take Profit order or lock in profits by yourself as the price is unlikely to rise above this level.

The thin red line is the entry price for opening short positions on a trading instrument.

The thick red line is the approximate price where you can place a Take Profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is crucial to monitor overbought and oversold zones.

Important. Novice traders need to make thoughtful decisions when entering the market. Before the release of important economic reports, it is best to stay out of the market as it may be extremely volatile. If you decide to enter market during the news release, then always place a Stop Loss order to minimize losses. Without placing Stop Loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that of you want to succeed in trading, it is necessary to have a clear trading plan, following the example of the one I presented above. If intraday traders make spontaneous trading decisions based on the current market situation, it may lead to big losses.