GBP/USD

Brief analysis:

Since October last year, the British pound has been steadily rising against the U.S. dollar. The current trend segment began on August 6 and is still ongoing. Over the past two weeks, the major has been declining, forming a correction on the chart. The calculated support passes through the upper boundary of the potential daily reversal zone.

Weekly forecast:In the first few days, the most likely scenario will be a decline and sideways movement along the support boundaries. A reversal and the start of a price rise are expected to follow. A brief decline below the lower support boundary is possible during the direction change but is expected to be temporary. The resistance zone marks the upper limit of the expected weekly range for the pair.

Potential Reversal ZonesResistance: 1.3270/1.3320Support: 1.3040/1.2990

Recommendations:Selling: Risky due to the limited downward potential.Buying: Will become relevant after confirmed reversal signals appear near the support zone.

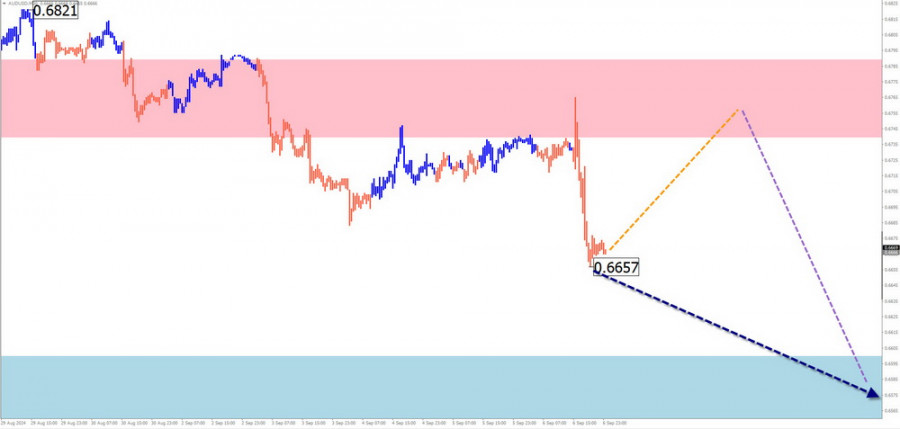

AUD/USD

Brief analysis:The upward trend of the Australian dollar major over the past month has brought the price into a large-scale potential reversal zone. The current bearish phase of the wave started on August 29 and has not yet concluded.

Weekly forecast:In the next few days, the pair is expected to move sideways near the lower boundary of the resistance zone. Afterward, a resumption of the bearish trend is likely. The calculated support is at the lower edge of the strong reversal zone, where a halt in the decline and the end of the correction are expected.

Potential Reversal ZonesResistance: 0.6740/0.6790Support: 0.6600/0.6550

Recommendations:Selling: Consider the limited potential of the upcoming decline. It's safer to reduce the trading volume size.Buying: Will be possible after signals from your trading system appear in the support zone.

USD/CHF

Brief analysis:Since the beginning of August, the direction of the trend on the Swiss franc major's chart has been set by an upward wave. After breaking the intermediate resistance, the price has been forming an ongoing correction. The price has reached the upper boundary of a significant potential reversal zone, where it is encountering resistance.

Weekly forecast:In the first half of the week, sideways movement along the support boundaries is expected. Towards the end of the week, the likelihood of a reversal and the resumption of the bullish trend increases. The price may reach the calculated resistance levels this week.

Potential Reversal ZonesResistance: 0.8690/0.8740Support: 0.8410/0.8360

Recommendations:Selling: Not advisable in the upcoming week.Buying: Can be used in trading after confirmed signals appear from your trading system.

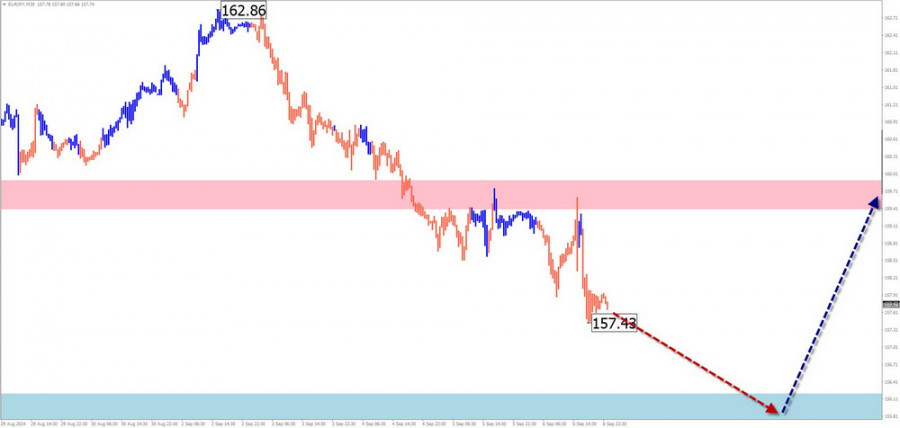

EUR/JPY

Brief analysis:The price movement of the euro/yen pair over the last month has been driven by an upward wave. The corrective phase of the trend is not yet complete but is approaching its final stage. The wave structure does not yet appear complete.

Weekly forecast:In the coming days, the pair is expected to move sideways with a downward trend. In the latter part of the week, a reversal and resumption of the upward trend are likely near the support zone. A sharp volatility spike is possible during this period.

Potential Reversal ZonesResistance: 159.40/158.90Support: 156.20/155.70

Recommendations:Selling: Possible with small volume sizes within intraday trading.Buying: Can be used after confirmed reversal signals appear from your trading system near the support zone.

AUD/JPY

Brief analysis:Following a prolonged corrective phase, the direction of the AUD/JPY pair since August 5 has been set by an upward wave, primarily moving sideways. In the past three weeks, the price has been forming a correction that is still ongoing.

Weekly forecast:

The pair is expected to maintain its overall sideways movement throughout the week. A downward trend is more likely in the first half of the week. A reversal and movement toward the upper boundary of the price range may be expected from the support zone.

Potential Reversal ZonesResistance: 97.00/97.50Support: 93.40/92.90

Recommendations:Selling: May be possible after signals of a trend reversal appear from your trading system.Buying: Can be used with small volume sizes in individual sessions.

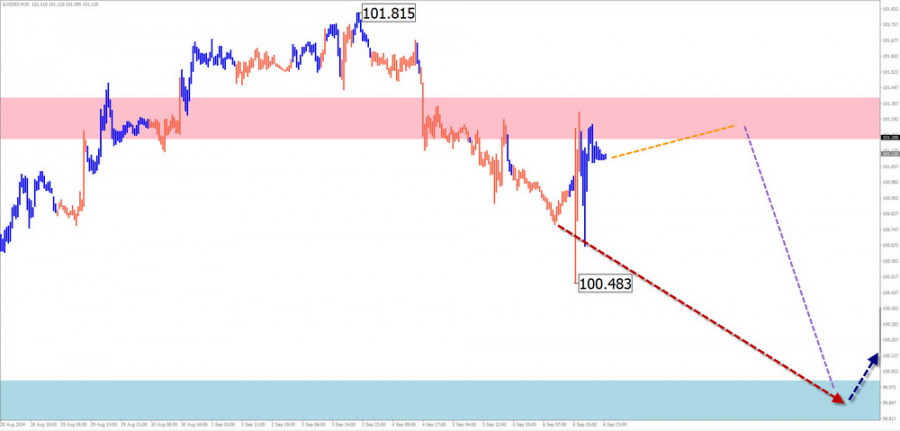

US Dollar Index

Brief analysis:For the past year and a half, the dollar index has been moving in a sideways range about 6 price figures wide. The price is approaching the upper level of a potential reversal zone. In recent weeks, a horizontal correction has developed near the resistance levels. Once this correction is complete, the index is expected to continue declining.

Weekly forecast:In the first half of the week, the continuation of sideways movement near the resistance zone is highly probable, with possible pressure on the upper boundary. Increased volatility and a resumption of the decline may be expected towards the end of the week, coinciding with the release of economic data.

Potential Reversal ZonesResistance: 101.20/101.40Support: 100.00/99.80

Recommendations:Dollar selling in major pairs may be short-term. Once confirmed reversal signals appear near the support zone, trading should be conducted with consideration of the strengthening of the U.S. dollar.

Ethereum

Brief analysis:Since the beginning of August, Ethereum has been in a correction phase following a previous weakening period. The current wave has reversal potential and may mark the beginning of a new bullish wave. Over the past three weeks, the price has been forming the middle part of the wave (B). A large support zone lies within the target area. A price drop below this level is possible but considered unlikely.

Weekly forecast:

In the coming days, overall sideways price movement is expected. A downward trend may occur, but it is unlikely to fall below the support zone. Towards the end of the week, volatility is likely to increase, with a reversal and upward price movement expected.

Potential Reversal ZonesResistance: 2450.0/2500.0Support: 2110.0/2060.0

Recommendations:Selling: Possible with small volume sizes within sessions.Buying: Not recommended until confirmed reversal signals appear from your trading system near the support zone.

Explanation: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). The last, unfinished wave is analyzed at each timeframe. Dotted lines indicate expected movements.

Note: The wave algorithm does not account for the duration of movements over time!