Analysis of EUR/USD and trading tips

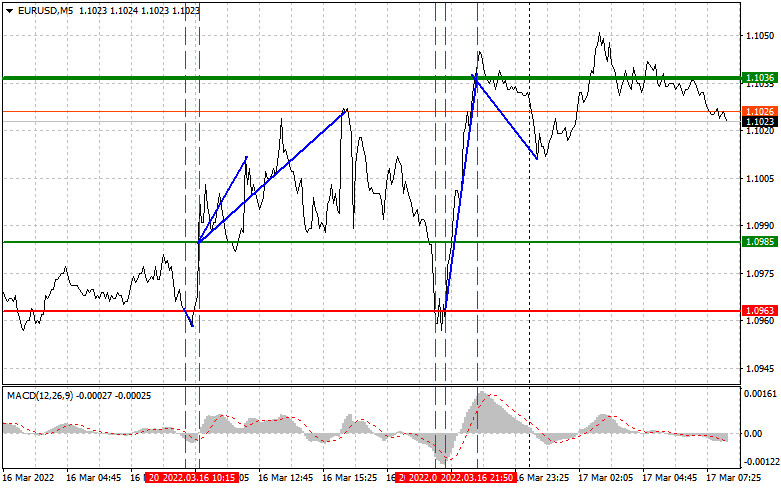

On Wednesday, I recommend selling the euro at 1.0963. The test of this level occurred at the moment when the MACD had just started to move down from the zero level. It confirmed the correct entry point into the market within the trend. Unfortunately, the decline was rather modest and traders had to close unprofitable positions. However, a bit later, the situation changed rapidly. The test of 1.0985 happened at the moment when the MACD started moving up from the zero level, which was a signal to buy the euro. As a result, the euro rose by more than 45 pips. After the Fed's decision to raise the benchmark rate, scenario No.2 for purchases was relevant. I described it in detail in yesterday's article. The second test of 1.0963 at the time when the MACD indicator was in the oversold area gave a buy signal. After that, the euro jumped by more than 70 pips. Short positions for a rebound to 1.1036 also brought about 20 pips.

Yesterday, traders focused their attention on the results of the FOMC meeting. Policymakers led by Chair Jerome Powell voted 8-1 to hike the key rate to a target of 0.25% to 0.5%, the first increase since 2018. The central bank has been keeping the key rate near zero for two years in order to cushion the economy from the pandemic. As the economy has almost revived from the coronavirus crisis, the Fed is ready to start the monetary policy tightening cycle, namely raising the key rate to 2.5%. St. Louis Fed President James Bullard was against a half-point hike. Today, in the first half of the day, the economic calendar will be empty. It is extremely bullish for the euro. Forex strategists expect the euro to continue its short-term rally. In the afternoon, the US will unveil reports on building permits and industrial production. If all indicators turn out to be strong, it will be an extra confirmation of the healthy state of the US economy. In the case of weak data, the US dollar is likely to decline. The main catalyst for the growth of risky assets will be news related to the negotiations between Russia and Ukraine. The Kremlin stresses that an Austrian/Swedish neutrality model for Ukrainian, preserving their own Army but without foreign military bases, might be used as a compromise. Kremlin spokesman Dmitry Peskov refused to provide comments. However, he confirmed that the Austrian/Swedish neutrality model for Ukraine is being discussed.

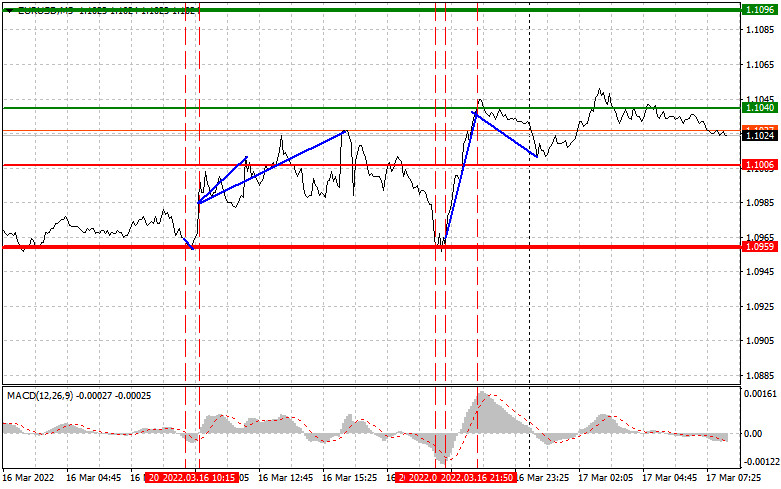

Buy signal

Scenario No. 1: today, it is recommended to open long positions in the euro if the price reaches 1.1040 (the green line on the chart) with an upside target of 1.096. I would advise locking in profits at 1.096 as well as opening short positions in the opposite direction, keeping in mind a 20-25 pip correction from the given level. The euro may climb higher today, especially after the Fed did not provide support for the overbought US dollar. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario No. 2: it is also possible to buy the euro today if the price approaches 1.1006. At this moment the MACD indicator should be in the oversold area, which will limit the downward potential. It may lead to an upward reversal. The pair is expected to grow to the opposite levels of 1.1040 and 1.1096.

Sell signal

Scenario No.1: you can sell the euro of the price hits 1.1006 (the red line on the chart). The target level will be 1.0959. I recommend closing short positions at this level and opening long ones immediately in the opposite direction, keeping in mind 20-25 pip correction from the given level. Risky assets are likely to gain momentum amid news on the progress in negotiations Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No. 2: it is also possible to sell the euro today if the price drops to 1.1040. At this moment the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may lead to a downward reversal. The pair is expected to slide down to the opposite level of 1.1006 and 1.0959.

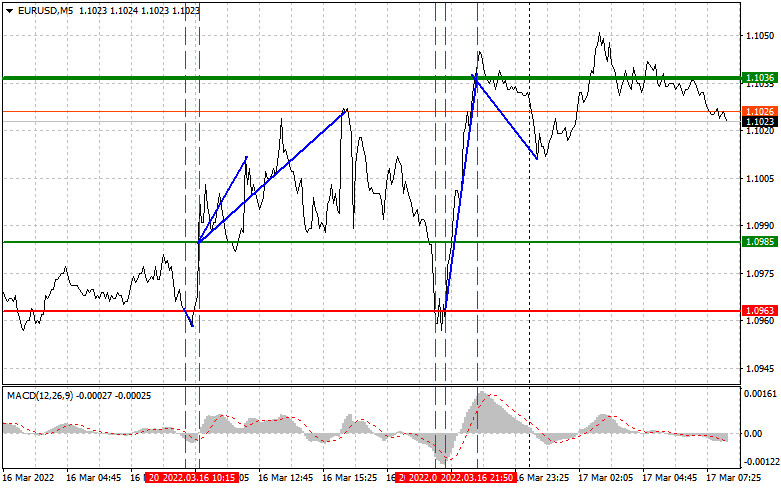

Description of the chart:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Spontaneous making of trading decisions based on the current market situation is initially a losing strategy of an intraday trader.