Analysis of transactions in the EUR/USD pair

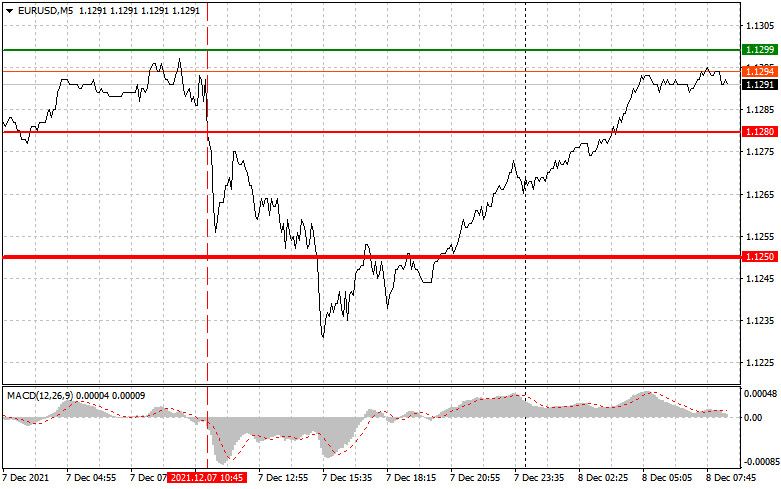

The 1.1280 price level was only tested once on Tuesday, which, unfortunately, did not lead to the formation of an entry point. At the time of the level update, the MACD indicator passed far enough from the zero mark, which limited the pair's downward potential. Thus, traders did not open short positions. However, weak data on the economy of the eurozone and Germany still led to a fall in EURUSD in the first half of the day.

The growth in German industrial production supported the euro, but a sharp decline in sentiment in the German business environment from the ZEW institute returned pressure on the trading instrument.

The report on the volume of eurozone GDP and the level of employment fully coincided with the forecasts of economists and remained unchanged compared to the preliminary estimate. For this reason, buyers of the European currency also did not find the strength to reverse the downward trend.

The growth of the U.S. dollar was led by data on a sharp reduction in the negative balance of the U.S. foreign trade balance. However, the sellers failed to keep the initiative until the end of the day, as a result of which the euro compensated for a significant part of the losses by the time of Tuesday's close.

Today, only a few speeches by European politicians will attract attention. The President of the European Central Bank, Christine Lagarde, and ECB Vice President Luis de Guindos will certainly talk about the future prospects of monetary policy in the eurozone, which could lead to a strengthening of the European currency if politicians are set to more actively curtail support measures.

ECB Governing Council member Robert Holzmann said Tuesday that he was very serious about the decision to raise interest rates in the eurozone earlier, even despite the continuing emergency bond-buying program.

The second half of the day may pass quite quietly since there are no important fundamental statistics on the U.S. economy. The report on the level of vacancies and labor turnover from the Bureau of Labor Statistics and the placement of 10-year bonds are unlikely to seriously affect the direction of the market. For this reason, buyers have every chance of euro growth.

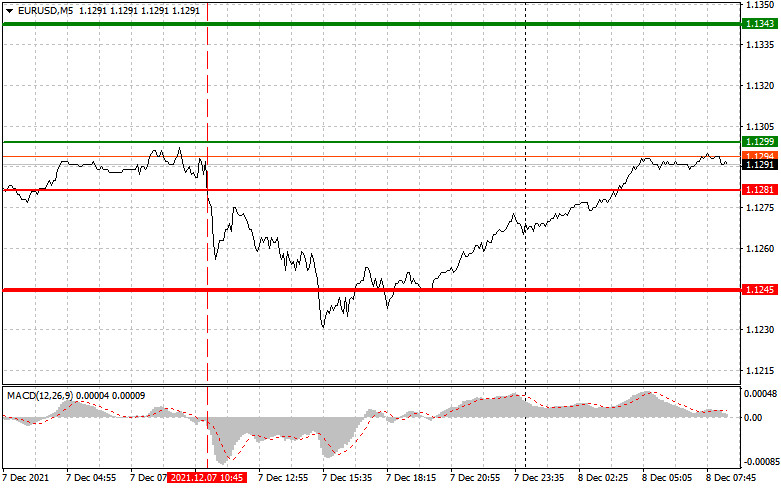

For long positions:

Buy euro when the price reaches around 1.1299 (green line on the chart) with the target of rising to the level of 1.1343. At point 1.1343, I recommend exiting the market with a profit and selling the euro immediately in the opposite direction (expecting a movement of 10-15 points in the opposite direction from the level). You can count on the growth of the euro after the speeches of the representatives of the European Central Bank. Growth will be limited by possible problems with the new coronavirus strain.

Before buying, make sure that the MACD indicator is above zero and just starting to rise from it.

It is also possible to buy 1.1281, but the MACD line should be in the oversold area, as only by that will the market reverse to 1.1299 and 1.1343.

For short positions:

Sell euro after reaching the level of 1.1281 (red line on the chart). The target will be the level of 1.1245, where I recommend leaving the market and buying the euro immediately in the opposite direction (expecting a movement of 10-15 points in the opposite direction from the level). The pressure on the euro will return in the case of the dovish statements of the ECB members.

Before selling, make sure that the MACD indicator is below zero and just starting to decline from it.

Euro could also be sold at 1.1299, but the MACD line should be in the overbought area, as only by that will the market reverse to 1.1281 and 1.1245.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.