GBP/USD analysis and trading tips

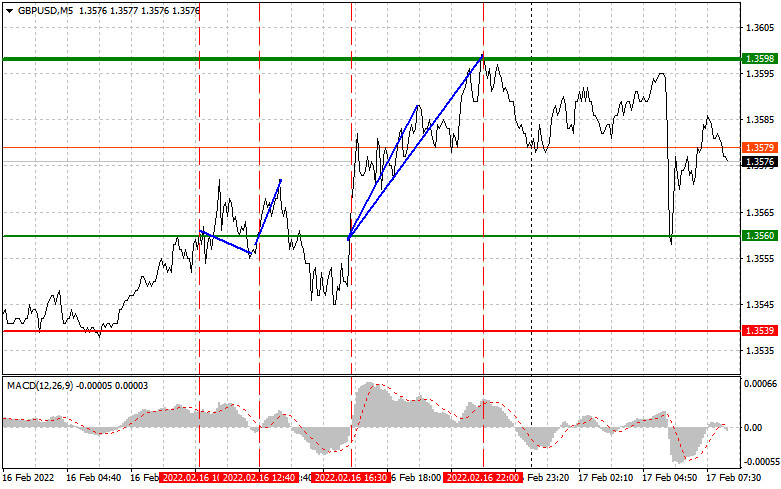

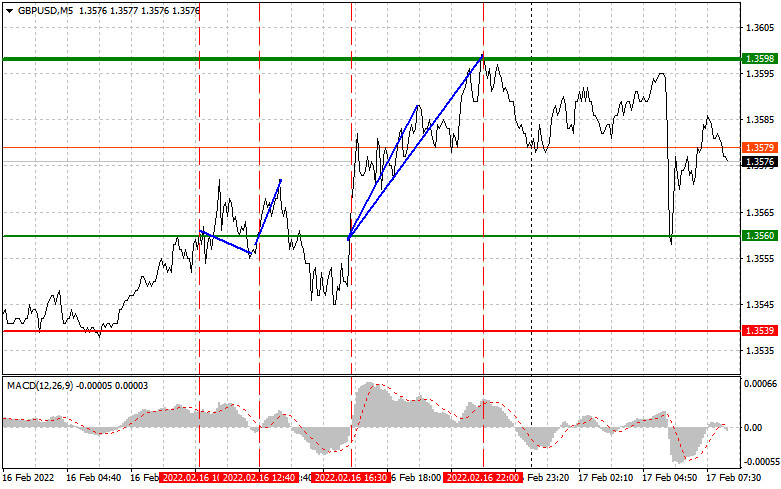

Yesterday, there were many entries into the market. The pound/dollar pair made an attempt to break through 1.3560 at a time when the MACD indicator was in the overbought area for quite a long time. It limited the upward potential. The entry point into short positions according to scenario No. 2 turned out to be unprofitable as the pair did not decline drastically. Shortly after, the pair tried to break above the target level. As a result, a bug single appeared on the chart. At the time of the breakout of 1.3560, the MACD indicator has just started to rise from the zero mark. For this reason, traders closed short positions and opened long positions. The pair gained about 15 pips. Only the third test of 1.3560 in the afternoon gave another excellent entry point into the long positions according to scenario No. 1. The pair advanced by 40 pips. Short positions on a rebound from 1.3598, which I highlighted yesterday, brought another 20 pips.

The pound sterling slightly rose following UK inflation data. Judging by annual figures, the decision of the Bank of England to tale a hawkish stance is quite sensitive. Notably, the monthly figure did not coincide with economists' forecasts and turned out to be slightly worse. The sharp rise in retail sales in the US in January did not spook GBP bulls in the afternoon. They are likely to try again to push the price to a monthly high. The sell-off of the British pound during the Asian session came as a surprise for intraday traders. Today, the economic calendar for the UK is completely empty. So, make trading decisions with the focus on the sideways channel and according to scenario No. 2 when buying and selling the pound. In the afternoon, the US will unveil its labor market data – the initial jobless claims report. If the figure is positive, the US dollar is likely to assert strength against the pound sterling. A bit later, the US will reveal the Philadelphia Fed Manufacturing Index survey and building permits data. However, investors are likely to pay zero attention to these macro stats. They will largely focus on the speech of FOMC member James Bullard, who is known for his hawkish statements on rate hikes.

Buy signal

Scenario No.1: it is recommended to open long positions on the pound sterling today when the price approaches 1.3585 (green line on the chart) with an upward target at 1.3625 (thicker green line). I would advise taking profit at 1.3625 open short positions on the pound sterling in the opposite direction, keeping in mind a possible movement of 15-20 pips from the given level. The pound sterling may also grow in the first half of the day after the breakout of 3585. Important! Before opening long positions, make sure that the MACD indicator is holding above the zero mark and it has just started to rise from it.

Scenario No2: it is also possible to buy the pound sterling today if the price hits 1.3564. At that moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is expected to climb to the opposite levels of 1.3585 and 1.3625.

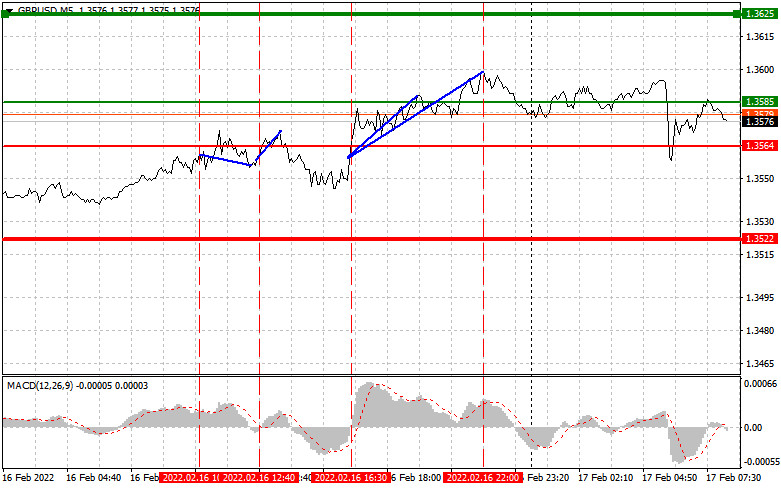

Sell signal

Scenario No. 1: it is recommended to open short positions on the pound sterling today as soon as the price reaches 1.3564 (the red line on the chart), which will lead to a rapid decline of the pair. The key target level of sellers will be 1.3522 where I would advise closing short positions and buying the pound sterling in the opposite direction, keeping in mind a possible movement of 15-20 pips from the given level. The pound sterling may fall deeper if the US initial jobless claims report turns out to be positive. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price hits 1.3585. At that moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also lead to a downward reversal. In this case, the price may move in the opposite direction to 1.3564 and 1.3522.

Description of the chart:

The thin green line indicates entry points to open long positions on the trading instrument.

The thick green line indicates the estimated level for setting a Take Profit or taking profit manually. The price is unlikely to move above this level.

The thin red indicates the entry points to open short positions on the trading instrument.

The thick red line indicates the estimated level for setting a Take Profit or taking profit manually. The price is unlikely to move below this level.

The MACD indicator: when entering the market, it is important to pay attention to the overbought or oversold areas.

Important: Novice traders should be very careful when making decisions about entering the market. It is better to stay out of the market ahead of important macroeconomic publications in order to avoid sharp price fluctuations. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

Remember that for successful trading it is necessary to have a well-developed trading plan like the one I presented above. Relying on spontaneous decision-making based on the current market situation is a losing strategy of an intraday trader.