The Resolution Foundation, an independent think-tank whose views are relevant in economic analysis, reported that British households are entering a year of lack. Rising energy bills and accelerating inflation are taking their toll, and they continue to affect incomes.

UK inflation in 2022 becomes warning to whole world

The pessimistic report, published some days before the New Year holidays, forecasts that real wages are likely to be little changed in 2022, growing only by 0.1%, although nominally (not adjusted for inflation) they may rise. In three years, their average level will be 740 pounds ($996) lower than it would have been if the pre-pandemic annual growth rate had continued.

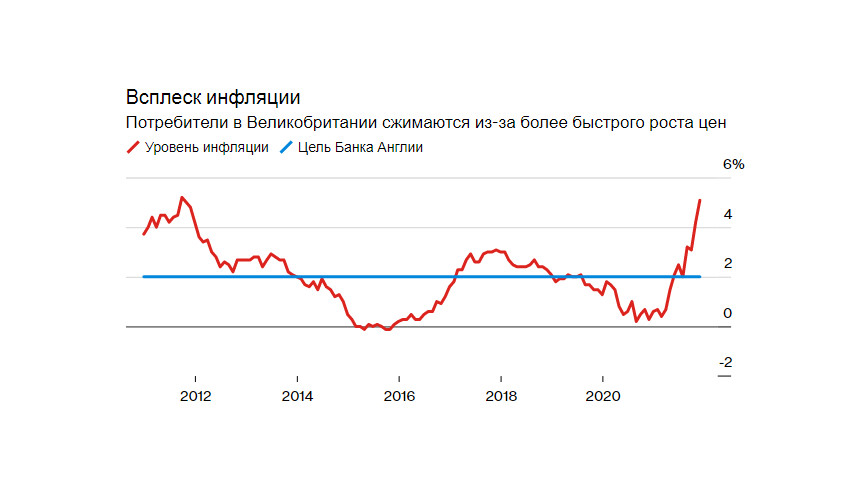

UK Inflation has already surpassed 5% and experts predict it to rise to 6 % early next year, the highest reading in three decades. That will hit consumers already dealing with the ongoing economic effects of the coronavirus pandemic. Moreover, it will also affect manufacturers, experiencing unusual difficulties for the past two quarters.

Chief executive of the Resolution Foundation Torsten Bell said that the Omicron variant would be the focus of concern at the beginning of 2022. He added that while the economic impact of this new wave was uncertain, it would be at least short-lived. He noted that 2022 would be a year of contraction.

The Resolution Foundation research estimates that the average impact on income from higher energy bills will be as much as £600, which will certainly affect the rate of welfare gains.

Apart from energy prices, consumers will face additional difficulties in April. At the beginning of the second quarter, Britain plans to increase taxes. They include the elimination of the reduced hotel and restaurant tax rate (one of the government support measures during the virus restrictions), as well as higher social security rates on wage packages.

Describing April as a sharp increase in the cost of living, the study says the government should contribute to reduction of end-user energy costs. It suggests such options as cutting energy cap increases by compensating suppliers for the difference and extending the time period for reimbursement for company costs that collapsed this year.

Energy pit

Earlier this month, a study from Investec Plc showed that the total increase in household energy costs next year could amount to 18 billion pounds ($24 billion), potentially reducing consumer spending and putting additional pressure on the Bank of England to raise interest rates.

Analysts Nathan Piper, Sandra Horsfield and Martin Young wrote in a report that rising gas prices have reduced the cap (the maximum amount that firms can charge customers) and are on track to increase by 56% in April, an average of 2,000 pounds per household annually.

It occurs when the government is taking the first steps to help ease the country's energy burden, where 24 domestic service providers have gone bankrupt since early August. The cost of redistributing and paying these customers has to be picked up by the rest of the market, including a sum of 1.7 billion pounds for Bulb Energy Ltd., hurt badly by the energy crisis.

The regulator predicted that the collapse of suppliers would add 80 to 85 pounds to energy bills until 2022-2023. The increase could also add 1.8% points to overall inflation in April. The overall increase also represents about 1.3% of consumer spending, forcing Uk citizens to rethink their consumption patterns, forcing them to save on entertainment and non-essential spending.

Investec said that households would reduce discretionary spending on other items, use their excess savings accumulated during the pandemic to cover the increase in bills or would get higher wages from employers.

Analysts assumed that this position was likely, taking into account the general tight labor market. This fact could exacerbate inflationary pressures and possibly trigger further rate hikes by the Bank of England.

The energy situation on the island, as well as in the eurozone, reminds the world that during the coronavirus pandemic the economic component is much more vulnerable than usual: any factor can be significant and put monetary policy into austerity mode.

So far, the FTSE indices are rising. For example, the FTSE 100, has added 0.04% in the current session, while the broader FTSE 250 has gained about 0.73%. The market seems to have already considered these risks when the Bank of England raised rates this month. However, traders should exercise caution in trading the pound and other assets at the start of the second quarter of 2022, as a range of news related to tax hikes and other payments could affect regional quotations.