Dollar continued to rally, thanks to the statements said by current and former representatives of the Federal Reserve. Everyone unanimously spoke about potential rate hikes in the US next year.

Meanwhile, the released statistics for the Euro area helped euro maintain its position in the morning, but the data on US retail trade turned the situation around and brought demand back to dollar.

Former New York Fed leader William Dudley and former Richmond Fed president Jeff Lucker said yesterday that there is a high chance that the central bank will raise interest rates next June, and will do so regularly until it reaches 1.75%. But the momentary peak is expected to be around 3%-4%, which could push the economy into recession.

For now though the rates range from 0%-0.25%, and during the last meeting the Federal Reserve said it will maintain this until employment completely recovers. Unfortunately, ongoing inflationary pressures cast doubt on everything, especially over when the central bank will make decisive actions.

Both Dudley and Lucker have suggested that the Fed accelerate the cut in bond purchases in response to the surge in inflation. After all, earlier this month, the Federal Open Market Committee already announced its plan to taper monthly bond purchases at a pace that would allow it to complete its entire program by mid-2022.

When asked about candidates for the post of Fed Chairman, former Fed members said they saw little difference between Jerome Powell and Lael Brainard. Powell's term ends in February next year, and Biden must decide whether to reappoint him for a second term or raise a new candidate.

In terms of Fed stimulus, St. Louis Fed President James Bullard said the committee should hasten its tapering in order to curb the ongoing rise in US inflation. He said there is a need for more aggressive approach because only by that will the central bank properly control inflation. Bullard also noted that if necessary, the committee could raise interest rates even before the completion of the bond purchase program.

These statements became a serious bullish impulse for dollar, especially after data came out that CPI rose 6.2% y/y, the highest since 1990.

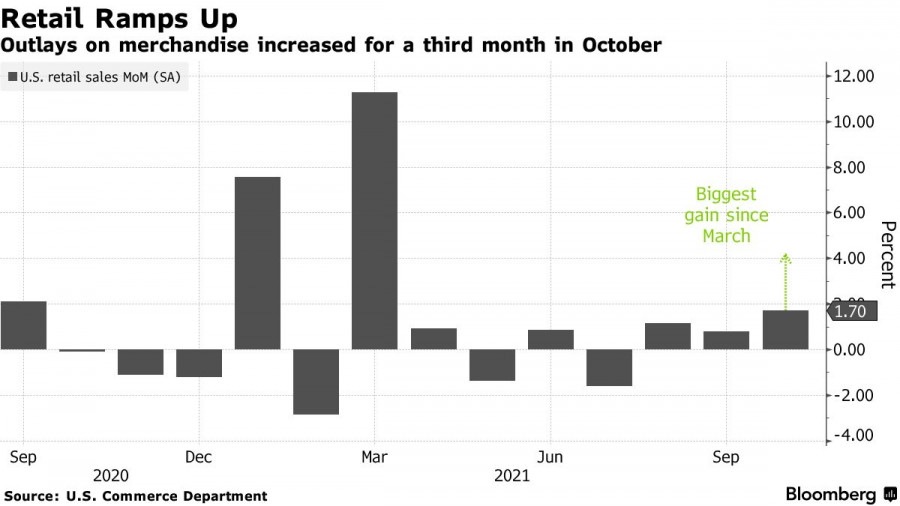

US retail sales also jumped in October, continuing the increase seen in the past three months. This shows that households continue to spend their savings even with the highest inflation in decades. According to the data, sales rose 1.7%, after increasing by 0.8% in September. Excluding gas and cars, sales rose 1.4%.

But even though total retail sales are well above pre-pandemic levels, serious inflationary pressures could be substantially adjusted by the end of this year. The US Department of Commerce said prices have been rising at the fastest pace in 30 years, mainly due to increased labor costs and high manufacturing costs to customers. More significant-than-predicted gains could also be attributed to pre-holiday shopping, which is gradually gaining momentum. Many Americans fear the lack of gifts for the New Years and Christmas due to supply disruptions.

The report also indicated that consumer spending grew in the fourth quarter, slightly offsetting the slowdown seen last quarter due to shortages, supply disruptions, rising prices and fears of COVID-19 outbreak. Economists expect growth to continue in the last three months of the year amid improving labor and health care markets.

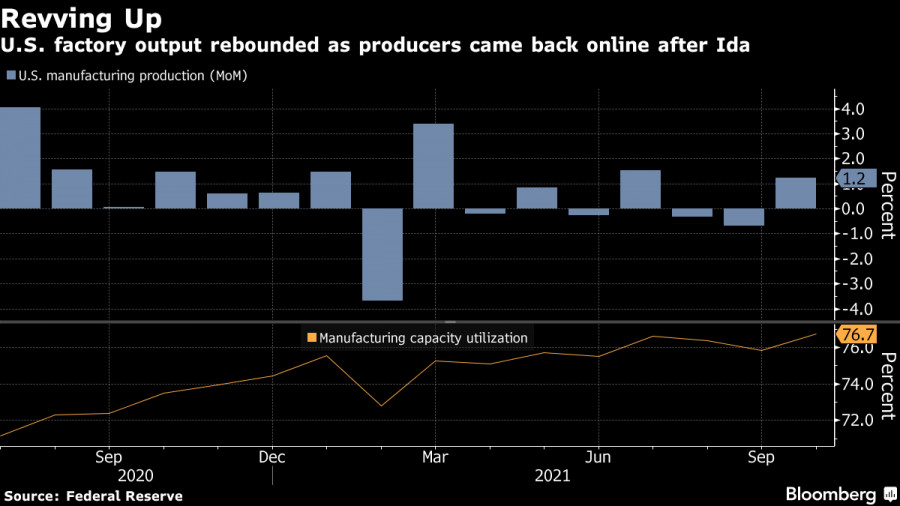

Industrial production also improved because manufacturers already coped with material shortages. The latest data indicated that leading industrial output rose 1.2% in October, after falling 0.7% in September. Total industrial production, which includes mining and utilities, also rose 1.6%.

It was the new business investments and strong consumer demand that boosted orders from manufacturers. However, it also led to depletion of inventories and an increase in unfinished business. Another driver was the 11% jump in the production of cars and spare parts because excluding it, production rose by only 0.6%.

Talking about EUR/USD, bears have reached 1.1280 and it seems that they intend to update the 12th figure. So far there is nothing capable of pushing the quote up, so it is likely that after the breakout of 1.1280, the pair will drop to 1.1260, 1.1220 or even 1.1190. But if the bulls manage to bring the quote to 1.1330, the pair will climb to 1.1360 and 1.1390.

British pound (GBP)

Pound remained in a sideways market despite good reports on the unemployment rate and

jobless claims. The main reason was the failed negotiations over Brexit, which dragged all attempts of bullish traders to build an upward correction. Also, the EU's chief Brexit negotiator warned that any move by the UK to suspend the existing protocol in Northern Ireland will jeopardize the whole trade agreement between Brussels and London.

Earlier, the UK repeatedly threatened to apply Article 16, which allows either party to impose safeguards in the event of "economic, social or environmental hardship." EU negotiator Maros Sefcovic said such a move will call into question the EU-UK trade and cooperation agreement, which was carefully drafted and signed on December 30, 2020. The next meeting of EU and UK is scheduled for Friday, but some EU member states are already pushing for a review of the termination of all or part of the trade agreement if the UK applies Article 16.