Analysis of trades and trading tips on the euro

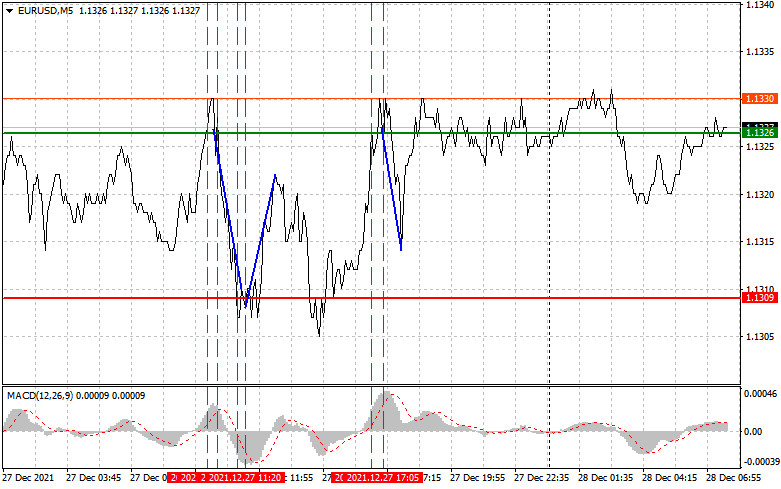

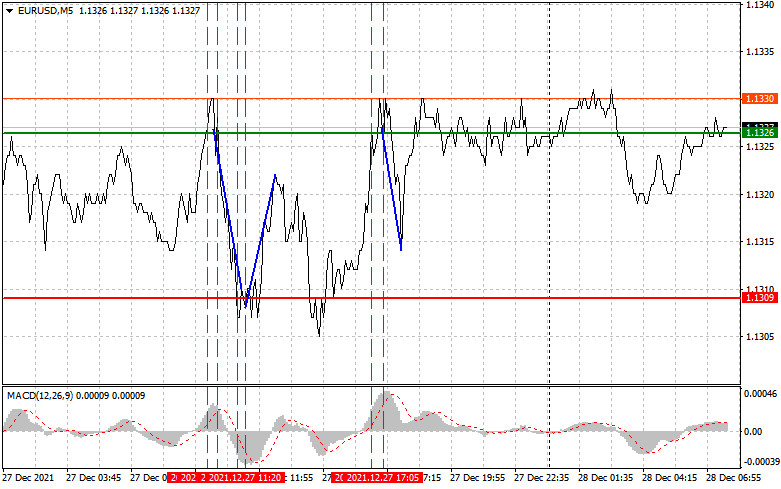

Despite low trading volume, volatility of the euro remains quite high. The price tested the level of 1.1326, when the MACD indicator was significantly above the zero level. This capped the upward potential of the pair. That is why it is not recommended to open buy positions. The price tested the mentioned level for the second time, when the MACD indicator was in the overbought zone. As a result, traders received a sell signal according to the second scenario. The pair lost about 20 pips. Then, it tested 1.1309. At that moment, the MACD indicator was far from the zero level, thus curbing the downward potential of the pair. The second test of the level took place when MACD was in the oversold area. Thus, traders received a buy signal. As a result, the pair advanced by 15 pips. Traders also opened sell positions at the level of 1.1326 during the US trade. The pair slid by 15 pips.

Yesterday, there was no important fundamental data. That is why traders preferred not to open big trades. Today, the eurozone macroeconomic calendar is also empty. However, judging by the current technical situation, bulls may become more active. Traders are focused on 1.1333.

The only report from France will hardly boost the market activity, but is still worth paying attention to. In the second half of the day, the US will publish reports that will have a slight influence on the pair. The house price index and S&P/Case-Shiller 20 City may support the US dollar if buyers of the euro fail to push the price above 1.1333. The Richmond manufacturing index data may also support the greenback if the final data exceeds the forecast. It is better to trade in the opposite direction from the mentioned levels and use the second scenario to find the right entry points.

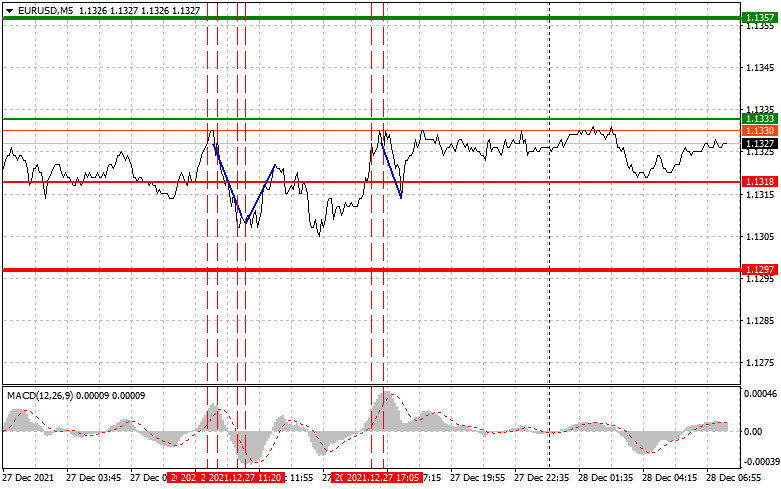

Buy signal

Scenario №1: today, it is possible to buy the euro, if it touches the level of 1.1333 (a green line on the chart) with the target of 1.1357. Traders should leave the market and lock in profit at the level of 1.1357. Today, the euro will hardly show a significant rise, but it is expected to break 1.1333.Before opening a buy position, make sure that the MACD indicator is above the zero level and it is just starting rising from it.

Scenario №2: It is also possible to buy the euro when the price hits 1.1318. At this moment, the MACD indicator should be in the oversold area. This will cap the downward potential of the pair and lead to the market reversal. The pair may increase to 1.1333 and 1.1357.

Sell signal

Scenario №1: traders may sell the euro after it touches the level of 1.1318 (a red line on the chart). The target is located at 1.1297, where traders should leave the market and open the opposite positions. If the price breaks 1.1318, the pressure on the euro is likely to increase. In addition, data from the US may remind traders that the US Fed is planning to raise the key interest rate to curb the inflation growth. Before opening a sell position, make sure that the MACD indicator is below the zero level and it is just starting dropping from it.

Scenario №2: today, it is also possible to sell the euro if it hits the level of 1.1333. At this moment, the MACD indicator should be in the overbought area. This will curb the upward potential of the pair and lead to the market reversal. The price may drop to 1.1318 and 1.1297.

What we see on the chart:

A thin green line is the entry price at which traders can buy a trading instrument.

A thick green line is the estimated price where traders can place a take-profit order or lock in profits, since the price will hardly go above this level.

A thin red line is the entry price at which a trading instrument can be sold.

A thick red line is the estimated price where traders can place a take-profit order or lock in profits, since the price will hardly go below this level.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important fundamental reports, it is better to stay out of the market to avoid sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place stop orders to minimize losses. Without them, you can lose the entire deposit very quickly, especially if you do not use money management, but trade large volumes.

Please remember that for successful trading it is necessary to have a clear trading plan. Spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.